Posts Tagged → home

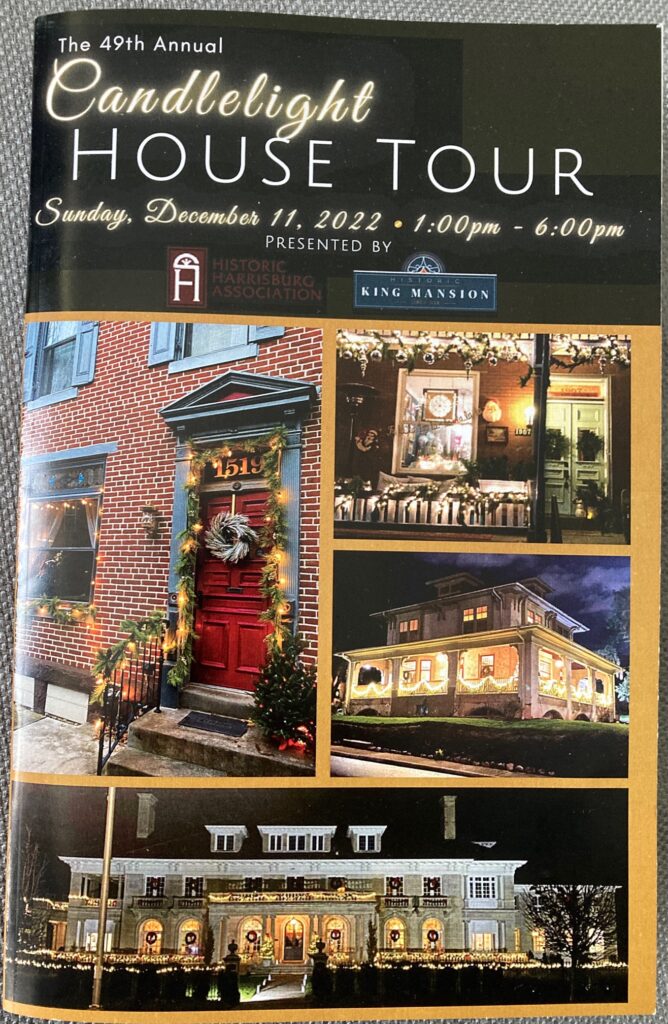

Harrisburg Candlelight House Tour 2022

The Princess of Patience and I have an annual event we enjoy, and that is the Candlelight House Tour organized by Historic Harrisburg Association.

The homes are historic, often brick and stone, but increasingly being rehabbed and rebuilt to suit modern lifestyles. Mid Town Harrisburg is the center of a great deal of this gentrification and re-use, the reclamation of its former glory days by investors, young couples, and entrepreneurs taking empty dilapidated homes and fixing them up into tax-paying structures once again.

Often the true downtown homes are as-is-as-found-as-was, somewhat cluttered and dark, filled with holiday tsatchkes, very homey and comfortable. These downtown spaces are all smaller attached homes from the 1860s-1900s, whose original materials and design often require a significant boost to make them truly livable today. And yet so many owners keep the original pine flooring, which is as attractive now as it was 130 years ago. Many owners aggressively incorporate new steel I-beams and wall materials, and install new windows in the former closed brick, while maintaining as much of the original construction as possible. The result is always a fun and harmonious combination of antique and modern, and I would say that most of them make me wish I had it as a pied-a-terre.

One of the big efforts is taking old mansions and commercial buildings and turning them into apartments. This is not an easy or cheap thing to do. When I was in graduate school, I lived in an old Victorian mansion on Lyle Avenue that had been turned into apartments by an enterprising cocaine addict named Steve. Steve lived in one of the larger apartments that spanned from the basement to the roof. One day, while watching Steve hold his own, raging drunk, buck naked and armed with a single shot .22 rifle, in an armed stand-off with the Nashville police, who had taken cover with their service revolvers over the hoods and roofs of their squad cars and a humorously deployed bullhorn, I came to appreciate the thick, strong brick construction of the building I was in. If the bullets ever flew, I was without a doubt immune to dying from acute lead poisoning behind those bunker-like walls. Ever since then I have admired the must-be-crazy people who seek to bring these clunky dinosaurs into the current day and age as livable spaces.

One of the people I spent time talking with was Nathaniel Foote, who took the old Carpets & Draperies building and provided Harrisburgers with luxury loft apartments. His emphasis is on short-term nurse housing. Another entrepreneur I spent time talking with was Justin Heinly, who has restored both the historic Cottage Ridge Mansion and the historic Donaldson Mansion next block down. Justin told me true rehab war stories, like finding old brick chimneys upstairs that had been pulled apart downstairs, thereby leaving thousands of pounds of hidden unsupported weight bearing down hard on the floors below.

This historic home rehabilitation work takes real dedication, risk, and sacrifice by people who have slight streaks of both crazy and artistic creativity. This work directly benefits everyone who lives in Harrisburg, or who owns real estate in Harrisburg. Thank you Nathaniel, Justin, and all the others who are making Harrisburg’s old abandoned areas now livable and desirable once again, one building and one apartment at a time.

And thank you to all of the home owners who let the public enter their private spaces, and to Historic Harrisburg, for bringing us all together as the community we are.

Real estate entrepreneur Justin Heinly keeps a smile on his face, despite encountering unbelievable engineering challenges resurrecting majestic old mansions for today’s renter

The Princess of Patience listening in surprise to home rehab war stories from entrepreneur Justin Heinly

Biden turns Trump into Modern Day George Washington

In 1783, at the conclusion of the Revolutionary War that established individual liberty for American citizens, Americans were debating whether or not to become a citizen-run republic (something completely new) or a monarchy (the most widespread form of governance and which all Americans were most familiar).

George Washington could have easily been declared the new king by popular acclamation, and he also could have easily declared himself the new king:

“At multiple times during his career, George Washington had the opportunity to permanently seize the reins of power and install himself as an American dictator. Never was this danger greater than in 1783. That year, as the Revolutionary War came to an end, many openly wondered whether or not Washington would use his position as commander of the army to usurp Congressional authority and personally consolidate power – a temptation to which countless other military leaders have succumbed throughout the course of human history. The great moment of truth had arrived and the nation’s future hung in the balance; the fate of millions, born and unborn, would hinge upon one man’s internal struggle between ambition and integrity.

Rather than become an American Julius Caesar, however, the father of our country was determined that the new nation should be a true republic. He resolved to lay down his command and return to private life. When told of Washington’s intended course, Great Britain’s King George III incredulously said, “If he does that, he will be the greatest man in the world.”

True to his word, on December 23, 1783 (239 years ago), George Washington voluntarily resigned his commission before Congress. To mark the event, a ceremony was held inside the Maryland Statehouse in Annapolis during which Washington spoke these words:

“I consider it an indispensable duty to close this last solemn act of my Official life, by commending the Interests of our dearest Country to the protection of Almighty God, and those who have the superintendence of them, to his holy keeping. Having now finished the work assigned to me, I retire from the great theatre of Action; and bidding an Affectionate farewell to this August body under whose orders I have so long acted, I here offer my Commission, and take my leave of all the employments of public life.”

To be sure, Washington was not done with his career as a public servant. Eventually he would be called upon to lead the Constitutional Convention and was later elected the first President of the United States. Invariably, however, Washington remained steadfast in his commitment to the democratic experiment and, as a result, our inheritance of liberty continues to this day. How very much we owe to the character of this one, remarkable, man. God bless George Washington.” (from Historic America)

Fast forward 239 years and America is now undergoing a revolution-in-reverse by the aggressive lawlessness of one political party and the nonchalant passivity of the other political party. Americans are watching in disbelief as their citizen-owned government is being devoured by unelected bureaucrats and tyrannical elected politicians, with help from the establishment media, Big Tech, Big Corporations, and many other un-elected political forces.

Our personal liberty hangs in the balance. Nothing highlights the precarious situation we are all in at this moment like the illegal FBI raid on President Donald Trump’s home in Florida.

The Biden Administration’s lawless attack on President Trump is not because he has done anything wrong. He hasn’t done anything wrong, and everyone knows it. If anything, the raid was an attempt to steal documents Trump had that incriminate the FBI and DOJ in law-breaking. The raid is the biggest act of conflict of interest in American history. Biden personally attacked President Trump with official, publicly owned assets, in order to politically damage Trump, so that President Trump would be diminished in the view of the voters who will be choosing between Biden and Trump in 2024.

Except that diminishment is not happening.

The opposite is happening.

In the wake of the DOJ+FBI’s corrupt personal assault on President Trump, Americans are now rallying around the president (Trump, the actual president). Because we all realize that Biden’s false accusation and lawless invasion of Trump’s home is really an assault on every American. If President Trump can be politically targeted and destroyed simply because he poses a political threat to Biden’s craving for absolute power, then all of us are at risk. Our collectively owned system of self governance is at risk.

This situation in many ways mirrors the cruel behavior of the British against the American colonists, and it is turning President Trump into the George Washington of our time. One man alone who stands between The People and tyrannical absolutism, and who alone stands for our freedom, and for an American government that is Of, By, and For The People.

George Washington was hounded by the British at every turn, from 1775 until 1783, when he defeated the British at Yorktown and ended the Revolutionary War. Trump is living up to George Washington’s greatness.

*UPDATE: FBI agents took Congressman Scott Perry’s cell phone while he was on vacation with his family yesterday. On the pretext that he spoke with President Trump. Can you believe this is happening in America? Joe Biden is at war with America, with everyone who disagrees with Biden’s attempt to censor and jail everyone who disagrees with him.

Home is Where the Heart Is

Home is where the heart is, goes the old and proven adage.

Home is that place you love, where you feel safe, loved, comfortable, surrounded by the fruits of your labors, like a flower garden behind a hand-laid stone wall, a manicured lawn, a bird bath or bird feeder, a porch for sitting on after a day of work. Maybe you raised a family in the home, and on bedroom walls in a couple places hidden from paint touch-ups there are some old finger prints from children who are now with families of their own. After putting so much work and love into your home, you naturally feel love for it. Just the memories alone inspire you!

So yes, your heart resides there, in your home, the ultimate symbol of all your efforts, the fruits of all your labors.

And so this is all true for those of us who have worked in and paid taxes here in America, our home, our house. Our Social Security payments, mine since I was fourteen years old, our volunteering for charitable organizations and Little League, our playing by the rules and laws of America, being good citizens. Always building the country up, making it a cozy and safe home for those who live here, who contribute to it, who will move here with the intention of participating in it.

And yet, unbelievably, America now houses people like US Reps Ilhan Omar, Rashida Tlaib, and other elected representatives, who are actually openly advocating for tearing down the national house, our home, America. These people are openly working every day to destroy the home that you and I have built. Along with “free” healthcare, income, education, and even a “free” home for people who have come here illegally, never paid anything into Social Security, and who themselves fly the flags of the other nations from which they come, where their hearts remain.

None of us lifelong taxpayers will ever get any of this “free” stuff, even though it is our tax money that creates it in the first place!

Can you imagine if some stranger walked into your house and began tearing the place apart, and offering to hand out your furniture, clothing, your food to passersby on the street outside? It would be even worse if it was someone you had invited in, so they could participate in all of the wonderful opportunities America offers to anyone willing to work hard. Well, this all is exactly what is happening with Ilhan Omar, Rashida Tlaib, and all of their supporters and enablers.

So it is a natural thing, an understandable and totally human thing, for our elected President to say “If you don’t like America, then go home to your parent countries.” He is definitely speaking for a majority of Americans. This should be no surprise to anyone. Every other country does the same. In every other country what Omar, Tlaib and their political party are doing would correctly be seen as treason and an intolerable act of war against the nation.

Like a lot of Americans, I applaud President Trump for writing this in one of his public messages the other day. Good for him. He understands that this current illegal invader situation is not sustainable. Not financially, not economically, not legally, not socially, and not politically. It is a testament to how good we Americans are at heart that this has been allowed to go on at all. We have such a strong generosity, even if we can’t always afford it. Americans are a giving people. Very few other nations, if any, will allow foreigners to literally walk into their nation and begin demanding free this and free that, tear down the border so anyone can literally walk in; it is quite insane. In most other countries, you would either be killed outright, or jailed, or expelled. Understandably.

Yes, we understand that there is a political party that has turned this illegal, lawless, anti-human, anti-America behavior into a business model, a way to gain political power. But just because that one political party is using and abusing the democratic process to achieve non-democratic results does not make this situation acceptable.

So I applaud President Trump for speaking out on behalf of the nation he was elected to lead, the home he was sworn to protect. He is doing what any American president is supposed to do. Anyone now opposing his standing up for America and our rule of law is openly a declared enemy of America.

America: Love it as it is, or leave it, as it is. And no, you cannot take our stuff with you. We worked for it, we built it, it is ours. It is not yours.

Paddling with Hollywood

Cheerfully our little crew paddled down the river, enjoying small Class II splashy whitewater rapids here and there, swift enough currents everywhere else that we need not really paddle much, if at all.

Turning aft, I squawked captain-like from my otherwise supine perch in the bow “Hard to the oars, ye pack o’ worthless lazy bones!”

The kids would laugh a bit at my best captain o’ the high seas bit, tepidly dip their paddles in the water like they were thinking about trying to paddle, and then go back to chattering amongst themselves about school, fellow students in school, classes, interpersonal politics and Politics with a capital P in school. Overall it was what had been hoped for when I made reservations with the outfitter the week before. Time with my kids and their friends, in nature, floating down a river, watching bald eagles, osprey, mergansers, wood ducks, migratory songbirds, deer, and on the lookout for bear.

Pausing to listen for and then spot white waterfalls cascading steeply out of the high canyon walls, I, the lookout, would occasionally point out where the crew could perhaps look up to if but briefly admire these little moments of grandeur passing by us. They did look the first half dozen times, and then tired of being bothered to do anything. I ended up dragging my hands in the cold foamy water, hoping to create some drag that would necessitate some serious paddling. When my hands turned red and then a purplish blue and stopped responding to commands to open or close, I gave up on influencing the kids in any way and just quietly admired the ride.

About two and a half hours into the drift, the kids started to sing. At first these were summer camp songs, and then theme songs from movies complete with beat-box noises from my daughter, and then songs from movies, mostly being rap-like. Their voices were sweet, and they would constantly run over each other, and then good-naturedly correct someone, and then try to get back on track in harmonic unison. Being of free and easy spirit, the kids were into having fun, and they would individually or together abruptly break out into a song-ending editorialization about the singer, the performer, the musician, or the movie the particular song came from.

The Earth Day environmental song, apparently popular now, was a big hit on our boat. They sang it over and over and over.

“And the zebra, I like how he says ‘I’m a zebra, I am striped, and I don’t know if I am black or if I am white’,” said the girl of this apparently surprising revelation, unaware that Dennis Prager, Rush Limbaugh, Larry Elder, and a slew of other radio talk show hosts and conservative politicians have been preaching an equal opportunity color-blind society for many decades.

And after about half an hour of back and forth chatter about this environmental planet cartoon movie and its song, it dawned on me that these kids are deeply enthralled by Hollywood and its entertainment business. They and their young impressionable minds are completely captured by images and made-up voices from highly paid songwriters and movie scripters, whose lines become memorized as moral guide posts along their young lives.

Many adults over the past ten or twenty years have bemoaned the advent of and then exponential increase in realistic at-home video games, the prevalence of handheld devices, and the trance-like state our children have grown up in glued to and Matrix-like plugged into these things. Well, I saw that we have transitioned beyond the gluing-in-and-tuning-out stage where we had to scream two inches from our kids’ face to ask them what they wanted for dinner. Now we see the fruits of others’ indoctrination labors playing out over a decade or more: Our kids are wholly owned little robots of the entertainment industry, which is vacuous, morally bankrupt, materialistic, shallow, value-less, corrosive, and meaningless. No wonder our kids parrot all kinds of silly nonsense that emanate from movies and popular music; they are constantly bathing their brains in it.

And people like me thought the fight for America’s soul was a political one in Washington, DC!

Nope.

I learned on that day-long raft trip through spectacular natural beauty that the fight for a solid America is still at home, where we thought we had some influence, and we still might, and on college campus, where our parenting has been outsourced to welcoming Marxist professors eager to turn our kids inside out.

Yes, on this trip I had been paddling along with my kids and their friends, enjoying their happy company, but really I had been secretly and unknowingly paddling with Hollywood that whole way, and did not realize it until the very end, when I could say nothing.

The sea captain and his crew taking a break in a wondrous, magical waterfall in the middle of nowhere, on the run from Hollywood and pop culture

Why California burns

Year after year, Americans are treated to images from California of flaming cars and zillion-dollar homes either burning down to the ground or sliding down canyon walls like toboggans on ski slopes.

No, these images are not from Hollywood movie sets designed to create fake images. These are the real thing, a hell on earth environment does in fact happen as badly on the ground each time we see it from afar.

Why these fires happen is right now subject to some debate, which does not make sense, because their explanation is very easy to understand.

No, President Trump did not cause these fires because his administration’s budget cut the fat off of some bloated California line item cost passed on to Americans everywhere. What a silly thing to say; it is just more “Trump did it!” goofball politics stuff.

No, “climate change” did not somehow cause these fires or the damage resulting from them. That would be impossible. Again, this is just silly politics stuff.

And no, sorry President Trump, these fires are not necessarily happening because California is mismanaging the forests there. That accusation would be correct for a lot of other Western areas, like Colorado, but I am sure that it does not apply to Malibu, California.

It is a fact that much of California’s landscape is a fire-based ecosystem, where wildfires are a constant, expected, and necessary part of the area’s natural cycles. Not only do the plants and trees there burn easily, some of them actually require fire in order for their seeds to germinate. For example, both redwoods and sequoias, two hugely famous trees that grow along California’s coast, have pine cones that will not open unless they are subject to fire. Without fire, these two tree species will not naturally regenerate. They evolved in a fire-based ecosystem.

Humans have built widely in this natural wildfire zone, by choice and with a lot of fore-warning about what they can expect while living there. So it is a mystery why the humans there then run about wringing their hands and trying to blame politicians whenever there is a wildfire that burns down their poorly placed buildings. Serious wildfire is one of the few things they can actually expect to experience at least once a year, every year.

Additionally, the soils along the California coast are the absolute worst types of soil for building on. These are crumbly, loose soils that move around easily, often following gravity downward and carrying whatever humans have built on them along for the ride.

Think about it this way: New York City is famously built on bedrock, a great feature for standing still on a solid base when humans have invested billions of dollars on skyscraper buildings above. Coastal California soils are the exact opposite of New York City’s bed rock.

According to the U.S. Geological Survey, “[these] soils are on side slopes of hills and mountains. These soils formed in residuum and colluvium derived from inter-bedded shale and sandstone. Slopes are 4 to 75 percent.”

What this sciency lingo means is that these soils are loose and easily eroded. Moreover, fire temporarily reduces plants holding the soil together, and then water carries the especially but temporarily loose soil to the ocean. This is natural, it is how this area was created. Building on it is foolish.

A dear friend of mine owns a wonderful vacant lot in the heart of Malibu. Her large tract overlooks the Pacific Ocean and is surrounded by very expensive futuristic homes. Despite this lot’s beauty, she hasn’t built on it yet, because it has been washed away several times and burned at least once. One night we were looking for her corner survey stakes, and we found them down the street. About two feet of soil had washed away in that rain storm; it was mass wasting, really. A home there would have gone along down the street.

Which begs the question: Why would people build homes in a wildfire-dependent ecosystem and on soils that are as slippery as wet soap and as solid as sand?

Well, there is another question, too, which is why are all those expensive homes built on the San Andreas fault? But we can’t answer that until The Big One rocks California to the bone (and we get to see if Californians have an ounce of self-reliance left).

More important, something is going on with the people who live in California. This ‘something‘ is not good, because they are living in a self-imposed fantasy land that does not want them to live there; it is trying to burn them out and flush their buildings into the Pacific Ocean. The people there know what to expect, and yet they do the wrong thing anyhow, over and over.

Watching them now trying to blame President Trump for their own poor judgment would be funny, except the political consequences are serious.

California: Beautiful place, fascinating geology and ecology.

Californians: Bad character, poor judgment, American taxpayer welfare queens.

UPDATE: A friend commented and pointed out that New Orleans is built below sea level next to the seashore, and that Miami is built on a sand bar in the direct path of most hurricanes, and that Phoenix, Arizona, is built in an arid desert with no water anywhere around. These are all similar examples of humans tempting fate and defying Mother Nature. Good luck with that. And yes, I do feel badly for the people who have been directly affected by the most recent fire around Malibu, Paradise, and other California locations. How could I not feel bad for them? It is a sad situation. But the message of this post is that humans cannot successfully defy Mother Nature. It just never ends well for either party, but unlike the humans, Mother Nature can almost always fix herself. Humans need better development planning.

Your home’s property taxes: “They are called special interests for a reason”

Guest commentary from grass roots activist Ron Boltz, and first published at www.papra.org:

They’re called “special interests” for a reason. Of course I’m referring to the scores of lobby groups in Harrisburg who often fight against good ideas or good legislation, or push for bad ideas and legislation, depending upon how it affects them personally or the relatively small group which they represent. The degree to which a proposal helps or hurts others or our State is often irrelevant to special interests. Following the money is almost always the path to an explanation that might otherwise not make much logical sense, and then the true motivations become clear. It’s the same as it ever was.

While this is nothing new, it’s nonetheless very frustrating when these lobby groups unashamedly flip their talking points when it benefits them to do so, completely contradicting statements they’ve made previously. Such is the case with the PA Chamber of Commerce and the Tax Foundation’s recent proposal to overhaul Pennsylvania’s tax structure.

When lobby groups oppose ideas that are popular with the public, they often conjure up phony “reasons” to justify their opposition rather than openly stating their real objections. We’ve seen this time and time again with The Chamber and their refusal to even consider school property tax elimination. Americans for Prosperity and The Commonwealth Foundation also joined them with disappointingly weak excuses of their own.

For example, The Chamber says things like “we can’t tax diapers!” and “we have to fix the cost drivers first”. AFP had their all-encompassing “we don’t support tax shifts”, and Matt Brouillette loved his dumbed down “left pocket-right pocket” analogy in an attempt to use bumper sticker politics to demonize elimination. For those who haven’t heard it, let me explain so you can understand what we’ve been dealing with.

Matt would say something similar to “it doesn’t matter if you take money out of your left pocket or your right pocket, you’re still paying and it’s still money coming out of the economy”. This was his attempt at bashing SB 76, which is being proposed as a revenue-neutral school property tax elimination plan that would shift the burden to the income tax and the sales tax. He was trying to imply that we would be no better off under such a plan, and everybody would be paying the same regardless. This type of talking point may resonate with some, but it’s easy to blow holes in his analogy.

His own example basically says that he doesn’t believe tax policy matters. According to Matt, if it’s the same amount of money collectively, then it’s irrelevant how the money is taken from us. Of course we do know that tax policy matters, especially when we’re talking about how many “pockets” we’re taking the money from. SB 76 expands the tax base, which is extremely important. It also matters how much money we’re taking out of each pocket.

If we take $1 out of the pocket of someone who has $10, we’ve taken 10% of his or her earnings. If we take the same $1 out of someone who has $100, we’ve only taken 1% of that person’s earnings. This is the nature of the property tax. It applies different rates to everybody, is not based on our income, and it’s also very regressive.

During my travels, I met a single mother in Monroe County who is forced to “contribute” 14% of her income toward her school property taxes. Last week I spoke to a woman in Lancaster County who, since the reassessment that took place there, is now paying a full 25% of her and her husband’s income in property taxes.

This scenario plays out everywhere across the state. The only way to solve this is to completely eliminate the school property tax and replace it with a broader-based method that applies the exact same tax rates to everybody, regardless of where you live. The property tax system cannot be fixed, and it can never be “fair”. Our opposition knows this to be true, but they avoid talking about these things in their defense of the status quo.

Putting all of this aside, if Mr. Brouillette truly believes it doesn’t matter which pocket the money comes from, then why is he fighting against it? If he really believes nobody would be better off, then he also has to be believe that we would also not be any worse off. Of course, my opinion is that Mr. Brouillette doesn’t believe his own talking point. He knows tax policy matters. For the record, I like Matt, and I find some of the data C.F. puts out to be very helpful. But they are wrong on this issue. Matt is no longer with C.F., but others in the organization also oppose school tax elimination.

We’ve always known that The Chamber really doesn’t care about taxing diapers, and we know their supposed opposition to expanding the sales tax base because “it hurts the lower income folks” is just playing politics. Their true opposition to property tax elimination would not earn them many accolades if publicly stated, so they join the PSEA and the PSBA in using emotional scare tactics. But now their new plan points out their own contradictions and makes it very clear that they are willing to make exactly the same opposing arguments if it means benefiting themselves.

As I give a few examples, I want to make it clear that the purpose is to highlight their contradictions and show that they really don’t mean what they say in regards to why they oppose school property tax elimination. I will not opine as to whether or not any of their proposals would be good or bad for Pennsylvania’s economy, and I’m not trying to invoke a class warfare argument. In order to have a productive debate, it’s necessary to talk about how different people will be affected, and it’s also necessary to talk about the relative fairness of our tax systems. That isn’t class warfare. It’s simply honest discussion, which is something in which our opposition has thus far refused to engage.

Included within the Chamber’s proposal is an array of options that include rate changes, tax eliminations, and the levy of new taxes. In other words…a myriad of tax shifts. There is no mention of any type of “cost controls” among their tax shifts plans, so I suppose that critique only applies to things they oppose, and not their own ideas. For the record, SB 76 does include spending controls, and I have long held that we will never get cost controls until we get spending controls. The reason we don’t have real pension reform or prevailing wage law elimination is because the state legislature, who mandates these things, gets to punt the responsibility for paying for them down to the school boards and the homeowners.

There is no accountability in the current system, and therefore no incentive to change it. How these lobby groups, who have been around politics for as long as they have been, cannot recognize this reality is beyond me. Perhaps spending so much time inside the Capitol courting politicians has clouded their vision. Perhaps they don’t know how politics really work after all this time, or maybe they really don’t want to see these problems resolved. I’ll let you ponder that on your own, but their “cost control” philosophy is akin to continuing to hand money to the irresponsible while asking them very nicely to curtail their bad habits, with no consequences when they refuse.

Our philosophy, on the other hand, is to stop asking a group of people who have shown no willingness to control themselves, to please control themselves, and instead just cut off the money in order to force the issue. The property tax makes all of this overspending possible and is how they escape accountability. Eliminate the scapegoat, restore accountability, and watch as these things magically begin to be addressed in a meaningful way. Until then, be prepared to continue to watch the pension problem get far worse, property taxes continue to skyrocket, and the finger-pointing to resume with nothing being done.

Getting back to the Chamber’s proposal – They call for a lowering of the Corporate Net Income Tax from 9.99% to 5.99% or 6.99% (depending on the option), and the elimination of the Gross Receipts Tax on businesses. To pay for this, the plan calls for an expansion of the sales tax base, a new local income tax, and the first ever tax on retirement income. It says that the new retirement tax revenue could be used to “buy down” the PIT (Personal Income Tax) rate to 2.5%, but says that it would be “better used as a pay-for to reduce less competitive tax rates elsewhere.”

In other words, the Chamber wants retired seniors to pay a new tax in order to lower business taxes. But don’t fret, seniors…they’re generous enough to entertain the possibility of using some of the new retirement tax to expand rent and property tax rebate programs for some seniors. But seniors won’t be the only losers in the Chamber’s tax shift. They also propose a local income tax on working families as a way to eliminate the Gross Receipts Tax.

Would these organizations please tell me again their views on redistribution of wealth, tax shifts, and the creation of new “winners and losers”? Pardon me for noticing some contradictions to what they claimed were their opposition to school tax elimination. Let’s examine a few of their talking points, and how they are seemingly no longer a concern when it comes to their own proposal(s).

The creation of winners and losers

They claim school tax elimination would just create new winners and losers. Our response is that the property tax system is responsible for creating winners and losers in the first place, for far too many reasons to list here. Everyone knows this to be true. Our proposal actually fixes this scenario by expanding the tax base from mostly just homeowners to everyone in the state who has an income, and to everyone who buys things (including tourists). In other words, everyone contributes. It also treats every taxpayer exactly the same by applying the same rate to their income, and the same sales tax rate to the same items and services. No more winners and losers paying different rates with enormous disparity an inequities.

While they love to use this talking point to criticize our school tax elimination proposal, they conveniently ignore the winners (businesses) and losers (senior citizens and working families) in their plan. Of course they will tell us that when businesses win, we all win, but I could say the same. When homeowners “win” with more disposable income, then businesses and the economy will also win. Businesses also win by making the entire state a KOZ (Keystone Opportunity zone) rather than the state picking the winners and losers. The Independent Fiscal Office report agrees.

The Stability of the tax

The Chamber, and virtually all of the public school lobby organizations, love to say that property tax revenue is “stable”, while other revenue from other sources is not. Therefore, they say, we cannot eliminate it. We always ask “stable for who?” For the tax collector? I suppose when you can constantly raise the rate, and with the threat of losing one’s home, the tax collector could view the property tax as stable. But what about the taxpayer? Is it stable for them? Absolutely not.

While the Chamber praises the property tax and touts it’s supposed stability, it has contradictory views of other taxes. In one section of their plan, they write about how governments tend to favor the Gross Receipts Tax because it produces large and stable amounts of revenue. It then goes on to say:

“…this revenue stability, however, does not outweigh the tax’s economic harm”.

Why then, does the Chamber love the property for providing the government with large and stable amounts of revenue, but then overlook the harm it does to the homeowner and the economy? Why does the same critique not apply to the property tax?

From the viewpoint of the taxpayer, the sales tax and the income tax are far more stable. Consider that the income tax in Pennsylvania has only been raised one time in the past 26 years. There was a 0.17 percentage point increase in 2004. The change previous to that was actually a lowering of the rate. That sounds pretty stable to this writer.

Even more stable is the sales tax, which has been 6% since 1968, but yet each of these taxes have continued to generate more revenue through natural growth, and they do so without the need for constant rate increases. I think we can all agree that Harrisburg has had no trouble spending more of our tax dollars in nearly every annual budget, and they do so mainly using these two funding sources. The Chamber’s report even touts the stability of the sales tax with this statement :

“Between 1999 and 2017, inflation-adjusted collections only diverged from the overall period’s average by more than 3 percent three times: once, when collections dropped in 2010, and again in 2016 and 2017, when collections comfortably exceeded the average”

While state revenues may decline temporarily during economic downturns, these periods are relatively short-lived, and the time spent in the black far outweighs the time spent in the red. In an Independent Fiscal Office report to Rep. Pashinski on August 16th of this year, there is a chart comparing the income tax growth rate to the property tax growth rate. This is a chart showing growth rate increases and decreases, so when the line goes down on the chart, it doesn’t represent a revenue loss until it goes below zero. Until then it’s still growth, and history shows the overwhelming majority of time is spent above zero. Legislators either don’t understand this, or they purposely try to spin this chart by saying it shows that the income tax is “too volatile” to be used to fund public education, but the opposite is true.

The IFO chart clearly shows that from 2004 to 20018, the property tax grew at a rate of 3.5%, while the income tax revenue (not the tax rate) grew at a rate of 3.4%, virtually the same. Again, this is with no rate increases on the income tax, but literally thousands of property tax millage rate increases during those years across our 500 school districts.

If the State can run their budget using the income and sales taxes as it’s main sources, and manage to grow spending year after year, then why can’t we fund public education this way? If taxpayers and homeowners are expected to manage their money during economic downturns, while they have fixed costs like property taxes and other bills to contend with, why don’t school superintendents and business managers, who are paid six-figure salaries, have the ability to do the same? If they cannot manage money the same way homeowners do, perhaps we should reconsider leaving them in charge of multi-million dollar budgets.

Taxes should be based on Income

One of the biggest problems with the property tax is that it is not based in any way on one’s income. Inaccurate assessments and unequal distribution of state money to our schools, combined with our homes not being a reflection of our wealth, leads to the enormous disparities in what each individual taxpayer must contribute toward the burden of funding public education. We have long condemned the property tax’s gross unfairness, inequities, and regressivity. Our State Constitution reads “All taxes shall be uniform, upon the same class of subjects, within the territorial limits of the authority levying the tax, and shall be levied and collected under general laws.” The property tax falls far short of meeting this mandate.

While the Chamber doesn’t care that the property tax isn’t based on income, their report laments the fact that the Occupational Assessment tax is inequitable and not based on actual income by saying the following:

“All of which is to say that the best measure of income is income, not a tax assessor’s best guess of what that income would be assuming that a given taxpayer hewed to the median for his or her profession.”

If that’s how they feel about the Occupational Assessment tax, then how can they praise the property tax, which is not only not based on income, but it’s not even based on an assessor’s best guest of our income. Rather, it’s based on an assessor’s best guess of the value of our home, and I don’t think I even need to opine about the inaccuracy of assessments, which their own report also acknowledges.

The Pyramid effect of taxation

The Chamber wants businesses to be free of sales taxes on business-to-business transactions, and they want to eliminate the Gross Receipts Tax because this results in multiple levels of taxation that will, in turn, increase the price of the product on the end consumer. This is a valid argument. The report gives an example showing the steps a bottle of beer goes through in order to reach a consumer at a restaurant. It shows the farm, the brewery, the distributor, the restaurant, and finally the customer. Using their own example, it’s obvious that the property tax also results in multiple levels of taxation, but this is not mentioned as a concern.

Not only does the farm, the brewery, the distributor, and the restaurant pay property taxes, but so do the manufacturers and the companies who make the parts to build the farm machinery and tractor trailers, not to mention the companies who build restaurant equipment. This too is passed on to the end consumer.

The Chamber claims that property taxes have a minimal effect on economic decision making

The report reads:

“Property taxes tend to be justified on both economic and practical grounds: economically, as a generally efficient form of taxation which raises revenue with a minimal effect on economic decision-making…”

Property taxes result in sheriff sales, foreclosures, and forced relocation when the burden can no longer bet met by the occupant. Proof of this abounds in page after page of newspaper tax sale listings. It is often said that 10,000 or more homes are sold at sheriff sales annually in Pennsylvania, a statistic that’s rarely challenged.

Escalating property taxes most certainly affect spending habits for both homeowners and businesses alike. As the PA Liberty Alliance goes door to door across the State, we’ve heard hundreds of stories of forced relocation, and how rising property taxes are doing serious damage to the finances of many families. I assure you that stories of senior citizens being forced to choose between medication and paying their property taxes are real. I’ve met these folks.

We also talk to small business owners who are struggling to compete, and who cannot expand due to the inability to pass on their skyrocketing property taxes to their customers the way a large business can. The Chamber claims to represent small businesses, but in our discussions we often hear these owners refer to the organization as “The Chamber of Big Business”. This seems to be a growing consensus in the small business community. A look at where the majority of The Chamber’s funding comes from might give clues as to why they so strongly oppose property tax elimination, and why many small business owners feel left behind.

The Chamber calls the property tax “efficient” and “practical”

In the previous section, I only included part of the quote. Here is the rest of the statement:

“Property taxes tend to be justified on both economic and practical grounds: economically, as a generally efficient form of taxation which raises revenue with a minimal effect on economic decision-making and consistent with widely accepted principles of taxation, and practically, as a well-established source of funding that is both familiar and not easily replaced.”

There is so much wrong with just this one sentence that it makes me wonder if we’re both talking about the same property tax. How anyone could call the property tax “efficient” is beyond comprehension for this writer.

Having to establish assessed values for every property in the entire state alone should make it obvious that this is the most INEFFICIENT tax we have. We need to hire appraisers, county assessors, and tax collectors to administer the tax. School districts must chase down delinquent taxes, and then go through the process of seizing the property when the homeowner doesn’t pay. Then we need to burden the county sheriff’s office with the duty of evicting the occupants, and then of course we need to go through the tax sale process.

Countywide reassessments cost taxpayers multiple millions of dollars each time, and always result in years of appeals that must be heard and dealt with. Maintaining the property tax system costs taxpayers enormous amounts of money. On the other hand, the sales tax is usually collected at the point of sale, and most people have their income taxes automatically deducted from their paychecks. I’m not suggesting there is no expense for businesses and taxpayers to comply with income and sales taxes policies, but modern technology has made it much easier and more efficient.

I don’t know what the Chamber considers to be “accepted principles of taxation”, and the report doesn’t elaborate, but it’s hard to imagine any standard in which complete inequity, inefficiency, unfairness, regressivity, and skyrocketing rates would be considered good principles. How can any tax that isn’t based on income, which the Chamber itself says is the best measure of taxation, be considered a tax with good principles?

The line about the property tax being “well established” and “familiar” sounds very reminiscent of the old “this is the way we’ve always done it, so it must be right” type of thinking. Are things that are “well established” and “familiar” always good? Of course not, but what the Chamber means by this is that businesses have adopted to the property tax and can pass on the cost, unlike a homeowner who cannot. Businesses have also mastered the appeals process and can have their assessments lowered if they become less profitable. Homeowners, on the other hand, cannot have their assessments lowered when their income goes down. They either have to pay up, sell their house, or don’t pay and the government takes their home, and usually most or all of their equity as well. This is devastating, unjust, and unthinkable in America where we are supposed to value property rights.

The Chamber’s Love/Hate relationship with the Income Tax

While The Chamber wants to shift the Gross Receipts tax to working families by instituting a new local income tax in its stead, the report also speaks of how the income tax “discourages investment and labor”. They claim that local income taxes encourage out-migration, particularly if it is not necessary to move far. They cite this as a reason that property taxes are better, suggesting the property tax doesn’t force anyone to move, or that it doesn’t play a role when deciding where to purchase a home or establish a business. I know plenty of people who moved due to large property taxes, but I don’t know a single person who told me they moved because of a local income tax. I also know some entrepreneurs who would have preferred to establish themselves in certain locations but the property taxes were prohibitive.

The report then says “…local income taxes are sustainable at modest rates, but create competitive disadvantages at higher rates, particularly those seen in Philadelphia and Pittsburgh” The local income tax in the overwhelming majority of the state is 1%, while the report says Philadelphia’s rate is 3.9%. So we can conclude that the Chamber considers a 3.9% local income tax to be a problem, but the 1% tax is sustainable. Let’s compare this to the property tax, which the Chamber props up and doesn’t believe to be a problem.

Most people pay far more than 1% of their income toward their school property tax, and as mentioned earlier, I’ve met one woman who pays 14% and another who pays 25%. Unless you have a money tree in your back yard, the property tax is still paid with our income, but it’s not actually based on our income. So if the Chamber sees a 3.9% local income tax as being a problem (as do I), then how can they possibly not see the property tax as being a much bigger problem? Does it no longer matter if we’re talking about homeowners rather than businesses?

Senate Bill 76 proposes a 1.88% income tax and an expanded sales tax, which the Chamber also calls for, in order to eliminate the school property tax. This would result in an overall tax cut for the majority of homeowners, backed up by multiple Independent Fiscal Office reports.

The question remains as to why the Chamber considers it good policy to institute a local income tax to pay for the elimination of business taxes, but it’s not O.K. to use an income tax to eliminate the school property tax? At the same time, how do they call a 3.9% local income tax a problem, but not a local property tax that levies a different rate on everyone, as high as 25% or more on some? These are rhetorical questions, as I believe the answer is apparent. They are a special interest group, and the well-being of the homeowner is not of their concern.

The Chamber opposes SUT expansion for property tax elimination, but call for it in their plan

After the property tax elimination effort got some traction in 2015, the opposition groups suddenly began to take the issue more seriously. The grassroots groups they previously laughed off were now making their voices heard. Since it’s very difficult to defend a tax that’s as despised by so many people as the property tax, they needed to come up with some new talking points.

This is when the refrain became “we can’t tax diapers!” Being led by The Chamber, lobby groups and politicians alike were singing off the same sheet of music. This was the new talking point that was designed to invoke emotion, while bypassing logic. Of course, we see this all the time in politics, and in this case, The Chamber now appointed itself as the champion of single mothers and their children. Imagine how heartless the property tax elimination crowd must be to propose a diaper tax!

Thankfully, the public didn’t buy it. At a town hall in Monroe County, a single mother who was struggling with her property taxes easily recognized that she would be far better off paying a relatively small sales tax on diapers than she would be paying property taxes, especially considering the property tax burden would be there for the rest of her life, or at least as long as she “owned” a home. We constantly hear about the supposed “regressivity” of the sales tax, but by definition the flat rate sales tax is not regressive. The property tax, on the other hand, actually is regressive when viewed as a percentage of income. In this case, the single mother didn’t even earn enough money to be a financial “loser” under the SB 76 proposal. She could have spent every dime she earned on the newly taxed items and still wouldn’t even come close to paying the same in sales taxes that she currently pays in property tax, even factoring in the PIT portion.

After all of their opposition to expanding the sales tax, I find it quite the contradiction to now propose exactly that. I can only assume that The Chamber doesn’t believe it’s own rhetoric as long as business taxes are reduced and eliminated rather than the school property tax. While they don’t suggest a sales tax on diapers, they do propose options that include taxing gasoline and motor fuels, even while acknowledging that we already pay the highest fuel taxes in the country. Imagine the impact of that tax alone on working families and commuters.

But they don’t stop there. Among many other items, they list clothing, shoes, prescription and nonprescription drugs, college and vocational school tuition, health and social assistance, veterinary services and food. SB 76 still exempts clothing under $50 per item, prescription drugs, heating oil, all food items that a W.I.C. check could purchase, medical procedures and other things. Missing from the Chamber’s list are services that only wealthy people would use, like airplane services. It seems to me that the Chamber’s proposal would be more harmful to the middle and lower class than would be the expansion under SB 76. But hey, at least they don’t tax diapers…

The Chamber claims school tax elimination would harm young, low income families and renters

The President of the PA Chamber has repeatedly said that SB 76 would be bad for his young son and his family, who he says shouldn’t be paying a higher income tax to eliminate school taxes for seniors. I’ve often wondered, but never asked, if his son owns a home, or ever plans to. While these same critics talk about the new “winners and losers” after SB 76 is passed, they never acknowledge that the current system is where the “winners and losers” are created, nor do they recognize the fact that their own defense of the status quo is nothing more than them trying to pick the winners and losers themselves.

The reality is, this legislation would help new families, the lower income, and the middle class homeowners. Most of these folks are paying far more than 1.88% of their income toward their property taxes, and even the additional sales taxes will not make them financial “losers”. This is backed up by an Independent Fiscal Office report issued to Rep. Frank Ryan on November 6, 2017.

According to the IFO, the median school property tax paid on a Homestead (which does not include commercial, vacation, or rental properties) is $1,972. The average is higher at $2,291. The report says that the median PIT impact of SB 76 would be $1,008, and the sales tax impact on the median income range would be $200-$400.

The report goes on to say that even the PIT impact is over-stated, as it’s calculated on the median household income of $53,599, which includes retirement and social security income that would not be subject to the income tax under SB 76. This figure also excludes Pennsylvania’s PIT Forgiveness programs for the low income, which completely excludes from taxation income up to $51,000/year for a family with four children, $41,500 for three children, $32,000 for two children, and lower incentives for one and no children.

With this data, the math is easy. Under SB 76, the worst case scenario for a PA family earning the median (not average) household income would be a new income tax impact of $1,008 and a sales tax impact of $400 for a total of $1,408. Since the median school property tax on a home is $1,972, this means that in a worst case scenario, which won’t even happen due to the overstated situation mentioned above, the savings for a family earning the median income and paying the median school property tax would be $564. The real world savings would likely be significantly higher.

Despite their best efforts to convince us otherwise, the special interest opposition is wrong. The wealthy are the most likely to end up paying more under SB 76, not the middle and low income homeowners. They wealthy are, after all, the people who may have a high enough salary, and who may spend enough money on the newly taxed items to result in a higher tax burden. I know quite a few wealthy people who contribute much less than 1.88% if their income toward school taxes. I don’t believe any of my middle or low income friends who own homes can say the same. Most are above 3%, many far higher, and as mentioned earlier, I now know someone who pays a 25% effective rate.

Renters also pay property taxes indirectly through their rent payments, as landlords must pass this cost on to their tenants at some point. We have U.S. Census bureau data that shows rents increasing at nearly the same rates as property taxes. This is not a coincidence. During our interactions with legislators, we often hear landlords being demonized as greedy and heartless, and we’re told that landlords would never lower their rents if SB 76 were passed. I find this to be yet another attempt at politics of emotion, and not logic. SB 76 would at a minimum stabilize rent costs. Some landlords would lower their rents on their own, and others would be forced to as the market adjusts and more people purchase their first home. Does the Chamber no longer believe in free market principles?

If these legislators are truly concerned about the impact to renters, the best thing to do for those folks would be to make homeownership easier for them to achieve. This bill certainly does that by removing a large part of the property tax burden. Part of the regressivity of the property tax is that millage rates tend to be the highest in our 3rd Class cities, where incomes are often lowest. In fact, in a study done by Joel Sears, a fellow Pennsylvania Property Rights Association consultant, he shows that a $30,000 home in Upper Darby has a monthly property tax payment over TWICE that of a normal mortgage payment in this price range. No wonder so many people are trapped into a lifetime of renting and being denied the pride of owning a home of their own, and becoming a lasting part of their community.

The problem with all of their arguments are that they are only based on a snapshot in time. It’s likely that immediately following the passage of SB 76, a family who rents may not benefit. It’s also true that seniors will likely benefit the most. But we don’t live in a snapshot in time. Young families and renters will buy homes of their own, go through the decades of their working lives, and hopefully make it to retirement in their senior years, meaning today’s renters will also benefit. The alternative is to do nothing and watch property taxes and rents continue to skyrocket, further damaging our economy and sending working families and businesses out of the state.

We always hear the talking point “if we want more of something, subsidize it, and if we want less of something, tax it”. Why then, does the Chamber support the current system that taxes homeownership every year, in an ever-increasing fashion, while we subsidize non-homeownership with rent rebate programs? The only logical answer is, once again, the Chamber doesn’t view homeownership as a benefit, or perhaps not even as a necessity, especially considering they seemingly have no issue with the government seizing homes as a result of this tax.

The Chamber’s plan for the property tax problem

While The Chamber praises the property tax, they do acknowledge it’s flaws in multiple pages of their report. They even cite a study by The Council on State Taxation which compares the uniformity and efficiency of property taxes in the 50 states. It gave Pennsylvania a grade of a D, and ranked us dead last.

So what is The Chamber’s solution? More frequent countywide reassessments. That’s their big “solution”. They also call for consolidated property tax bills, so we can pay one bill to the county, who can, in turn, distribute the money to the schools and local municipalities, rather than paying separate bills. There’s not even a new reduction scheme in their plan, which would only end up being a tax increase anyway so I’m really not complaining. Their answer is actually a tax increase, and as mentioned earlier, these reassessments are very expensive and time consuming.

Thanks to Joel Sears, we have data which shows that even countywide reassessments don’t fix all of the problems inherent in the property tax. He did a real life evaluation in Lancaster County which compared actual sales prices of homes that sold in the same timeframe as their recent reassessment, and compared them to the assessed values both before and after. He found that the same level of inequities exist even after these reassessments, and in some cases, they got even worse. That’s what taxpayers get for their multiple millions of dollars spent in an effort to make the current system more uniform.

Conclusion

Proof abounds that the property tax system is broken. It cannot be fixed. It cannot be made to be fair. Any reduction scheme will just be a tax increase as the property tax continues to skyrocket. Elimination is the only answer.

This absolutely can be achieved, and we can fund public education in a way that treats all taxpayers the same, eliminating the current winners and losers scheme. The Independent Fiscal Office confirms that homeowners would have more disposable income, home values would increase by an average of 10%, and the state would be more attractive to businesses. But apparently these benefits aren’t good enough for the Chamber, Americans for Prosperity, the PSEA (teachers’ union), or the PSBA (school board association).

These folks all view themselves as “winners” under the current system, and they don’t want to lose their stranglehold on the homeowner. They’re happy with us continuing to be the “losers”, and they spend millions lobbying in Harrisburg to keep it that way.

In addition to all of the contradictions listed in these pages, The Chamber also condemns the Corporate Net Income Tax because it doesn’t allow for cyclical profitability cycles, and they speak of how some businesses are hurt during periods of low profitability. At the same time, they praise the “stability” of the property tax for the tax collector, while ignoring that the tax always increases even if the home owners’ paycheck decreases, or goes away completely. Yet another double standard on their part.

Homeowners cannot pass their property taxes on to someone else, as businesses can. The buck stops with us. At the same time, our homes do not generate income, as commercial properties do. The current system is completely upside down and backwards, especially considering our homes have absolutely nothing to do with education. We haven’t always funded education this way, as the school property tax was only instituted in the mid 1960’s. Even our State Constitution lays the responsibility at the feet of the legislature, where it belongs, and not with homeowners.

No tax should ever have the power to leave one homeless, and our fundamental right to acquire and own property needs to be restored. If all of the other problems with the property tax aren’t reason enough to abolish it, these few reasons certainly are.

They’re called “special interests” for a reason.

Ron Boltz, President – PA Liberty Alliance

Consultant – Pennsylvania Property Rights Association

PSA: Please Keep Pets Inside

A pet is an animal that lives in a house.

Pets that are allowed to run freely out the front or back door, to cavort, chase, defecate, and frolic off its owner’s property and in Nature’s wide open beauty, are by definition feral.

Once out of the house or off the leash, these feral animals become capable of great destruction and usually accountable to no one. They also can easily be eaten by other feral animals and by coyotes, foxes, owls, and hawks. Or hit by a car.

Cats and dogs can get into traps set for fox, raccoon, coyote, and other furbearers.

Some of these traps merely restrain the animal by the foot. They do not break bones or cut skin. But other traps, like Conibears, will crush whatever sets them off, including a cat’s body or a dog’s face. If this possibility bothers a pet owner, then think of your animal’s safety, and do not let it run on someone else’s property; keep the pet under control at all times.

Audubon International estimates that feral cats alone wreak terrible destruction upon native songbirds, already under pressure from excessive populations of raccoons, skunks, and possums, killing hundreds of millions of colorful little birds annually.

Feral dogs bite people, chase wildlife, and poop on others’ property.

In most states, a dog seen chasing wildlife is subject to immediate termination. In fact I lost my favorite pet, a large malamute, after he broke out of his one-acre pen and a local farmer witnessed him gleefully chasing deer. Months later the farmer deposited the dog’s collar and name tag in the back of our pickup truck, told my dad where the carcass was buried on the edge of his field, and walked away. I was already heartbroken, but what could we say? Our dog had broken the law.

No responsible adult allows a pet to become feral. When it happens, it means the owner no longer really cares about the animal.

If you are a pet owner, please show that you care by keeping the pet safe inside your home. Everyone will thank you for it, especially your precious animal friend.

Historic Harrisburg gets an A+

Annually, in mid-December, Historic Harrisburg arranges a tour of historic homes around the city.

In the interest of showcasing our wonderful city, participating private citizens open the doors to their homes to utter strangers, who, for the modest price of the ticket, can walk through at their leisure.

Yes, there are docents, volunteers who stand guard over privacy and valuables, but nevertheless, strangers in abundance are in your home. Homeowners exhibit grace and panache, some swilling their umpteenth glass of wine, yes, but they maintain decorum and patience through a six-hour tour that would put me over the edge within an hour. Maybe less. Well, for sure less.

It’s an impressive commitment to place and pride in community displayed by these homeowners. In fact, the tour is a big statement about the sense of close, shared community we all share here in Harrisburg. Although I have lived in a bunch of different places, I have never seen anything like this tour, or this shared sense of belonging. Again: Absolute strangers are in your home, hundreds of them, and it works really well. It is an unusual arrangement. I like it.

Today’s tour was of homes mostly in Bellevue Park, a grand island of landscaping, natural contours, natural areas, and spectacular homes. My grandparents built a beautiful home in Bellevue Park many many decades ago, and I grew up going there for holidays. Summer visits involved playing in the large in-ground pool with my cousins and eating huge amounts of delicious food prepared by our grandmother, Jane. Winter holidays involved eating huge amounts of delicious food prepared by our grandmother, Jane, and then walking it all off around the park, followed up with playing pool in the basement.

My memories of Bellevue Park are long, distant, and misty-eyed. My grandparents were loving people, and we kids felt their love. Oh, how one longs for the simpler days of youth, with innocence and guileless smiles, statements of affection truly meant. Being in Bellevue Park today was like taking a time machine trip back 40 years. In a way, today’s tour was an expression of the same guileless, innocent sharing that we had as kids, but today was between and among adults and families who have previously never met one another.

Trust is the by-word for today’s Historic Harrisburg tour.

As it turns out, many of the older residents whom I met today recalled my family, and recounted trips they had taken with them, pool parties they had enjoyed there, John Harris High School events and teams they had played in together, and political events where the pool evoked then-fresh images of “Mrs. Robinson” and her lifestyle. And I met quite a few former colleagues and acquaintances, themselves taking stock of these updated homes for their own renovation plans, or providing valuable assistance as volunteer docents.

Isn’t that something. Community may always be where you find it, but one place it never disappeared from is Bellevue Park, Harrisburg, Pennsylvania. One other similar historic neighborhood I have seen is Squirrel Hill, in Pittsburgh.

It is also important to recognize the many gay men and couples who have ventured further out of the city’s center to bring revitalization to some of the park’s older homes. If there is a ‘down’ side to tolerance, it is that gays are moving ever farther from the urban cores where they have traditionally played a pivotal and leading role in the fight against urban blight by rehabilitating decayed neighborhoods. Now, gays are recognized as exemplary and desirable neighbors in traditional family areas; their colorful sense of style and personal flourishes are valuable, and are just not going to be replicated by anyone else. Surely not by me or my fellow knuckledraggers. Bellevue Park is now home to a large number of gay men. I won’t say it is a gay community, because it is not. It is simply a community with many gay people in it, and it is a great place as a result.

Thank you and an A+ to Historic Harrisburg for a fine afternoon well spent with my wife, who doted on every kitchen, every light fixture, every antique stained glass window, who relished meeting every single person today, and who left the going ga-ga over the omnipresent quartersawn oak all to me. Yes, there was tons of beautiful quartersawn oak in every home. That is pretty much all I remember. Oh, that and the old friends.

Out of all proportion

If there is one core element to the “new thinking” taking America down, it is victimology.

You know, the idea that everyone is a victim, and some people are special victims and some are especially victimized.

For someone to be a victim, there must be a perpetrator, and political correctness has created all sorts of creative solutions to real and perceived wounds which perpetrators can, or must!, endlessly do to atone. America has been afflicted with this, to the absurd point where illegal aliens crossing our borders in search of better work are “victims” and deserve our taxpayer money and the right to vote themselves a lot more of it.

It is a fair idea that people should be treated fairly. No arguing with that. But what happens when whatever apology, compensation, or other action worth remedying the problem has been completed, and the victim identity remains? This phenomenon is nowhere more clearly evident than in the Middle East, or technically the Near East, where “Palestinian” Arabs have wallowed in artificial and purposefully perpetuated victim status for five decades.

Even their refugee status is inherited, contrary to every other refugee situation around the world. The UN helps maintain this arrangement.

Although there were nearly twice as many refugee Jews ejected from Arab and Muslim nations at the same time, no one talks about them. Islamic imperialism and Arab colonialism are responsible for one of the largest and longest-standing occupations ever on planet Earth, where the farms, homes, and businesses that once belonged to Jews are now the property of supposedly well-intentioned Muslim Arabs. Billions of dollars worth of property and banks were stolen overnight, from one group of people and given to another group that had no claim on it other than they held the knife and gun, and the victim did not.

If someone were looking for victims to feel bad for, the Jews have had that victim experience in spades, not to mention the Armenians (Christians who suffered a none-too-gentle genocide and land-theft at the hands of the Muslim Turks from 1910-1915), Kurds, Tibetans, and, well, never mind that the iconic and fiercely warlike Oglala Sioux ejected the Mandan, Cheyenne, and Pawnee from millions of acres of their historic Happy Hunting Grounds and militarily occupied them for hundreds of years…after all, the American Indians who massacred, tortured, and occupied one another are considered to have engaged in acceptable behavior. Anyhow, I digress…..

The Jews now find themselves fighting for their lives with their backs to the wall, yet once again against Islamic supremacists, Islamic imperialists, and Arab colonists; and those same Jews are now presented with yet another double-standard: Proportionality.

This is the idea that, if someone hits you in the face with the intention of killing you, but fails to do so that first time and is winding up to hit you again and harder this next time, why, you are only supposed to hit them back once and only just as hard as you were first hit. You are not allowed to land a knockout punch, despite having survived an attempted knockout punch.

The EU demands that endless Arab rockets from Gaza onto indigenous Jews, living an unbroken 3,000-year presence in their homeland, be met with…thousands of random rockets from Israel? My God no! Unacceptable!

Obviously, the idea of proportionality is alien to every people that has fought a war, especially a defensive war. War is fought to be won, and dumbing-down and reducing the effectiveness of your response is a foolish and possibly suicidal thing to do.

But Europe and America cater first and foremost to artificial victims, and no matter what, those victims are due every gift, every extra opportunity, every kind gesture in the face of bloody hands, truckloads of taxpayer money despite tremendous waste by the recipients, and so on and so forth. Although this behavior seems suicidal, suicide seems to be the new definition of democracy, in the interest of appeasing the ‘victims’ among us, out of all proportion to whatever happened in the first place.

But to give the supposed victims their due, proportionality must be maintained, and in the Middle East today, Western civilization is expected to fight Islamic aggression, theft, murder, and occupation with both hands tied behind its back. It is apparently the new thing to do.