America needs an Exodus moment

America as founded is dying. The pro-individual rights constitutional republic carefully constructed through competing equal branches of government since 1789 is being forcefully bulldozed by rogue Big Government forces. Our unique system of checks and balances, meant to disperse power widely across the body politic, is under atttack at every turn. Central planners desire to collapse decision making into just a few hands.

Whether it is the Electoral College that prevents mob rule, or free speech under the First Amendment, or private ownership of firearms under the Second Amendment, or secure borders meant to protect free taxpaying citizens, every safeguard designed to protect the individual citizen is being ignored or forcefully broken into little pieces in front of our faces by the advocates of government totalitarianism. In our media, academia, and indeed from within government itself there is a huge emphasis on growing powerful big government and diminishing the ever smaller citizen into the role of powerless serf.

With FBI and ATF federal government excution squads running lawlessly amok across America, a weaponized and now heavily armed IRS looking deeply into the private lives of their political opponents, an enormous replacement of native Americans with lawless illegal aliens, the leading political leader being hounded by a dozen fake lawsuits and under threat of being illegally jailed during an election year, and on and on, America as a distinct nation based on the rule of law is dying. It is being killed, axe murdered, set on fire and blown up right in front of us.

Yes, one political party is directly responsible for this, but the other political party is enabling the attack by deliberately not fighting back or resisting. Both political parties are killing America, and with the failure of political leadership it’s now up to our citizens to decide how we want to live.

Tonight is the beginning of Passover, and it is a reminder that America needs an Exodus moment. We need a shining example of direct Diving intervention that results in our people being set free from the rampant lawlessness and injustice being forced on us, to make us all into slaves to Big Government. Hopefully, we are worthy of it. Incidentally, when the Jewish People left Egypt roughly 3,300 years ago, they were “chamushim,” meaning fully armed. Just as free Americans should be in 2024.

Pray hard, folks, and also prepare for the long, hard spiritual renewal journey ahead of us this year. Do not look to politicians for salvation or freedom, that road is now closed. Rather, look to each other and to God.

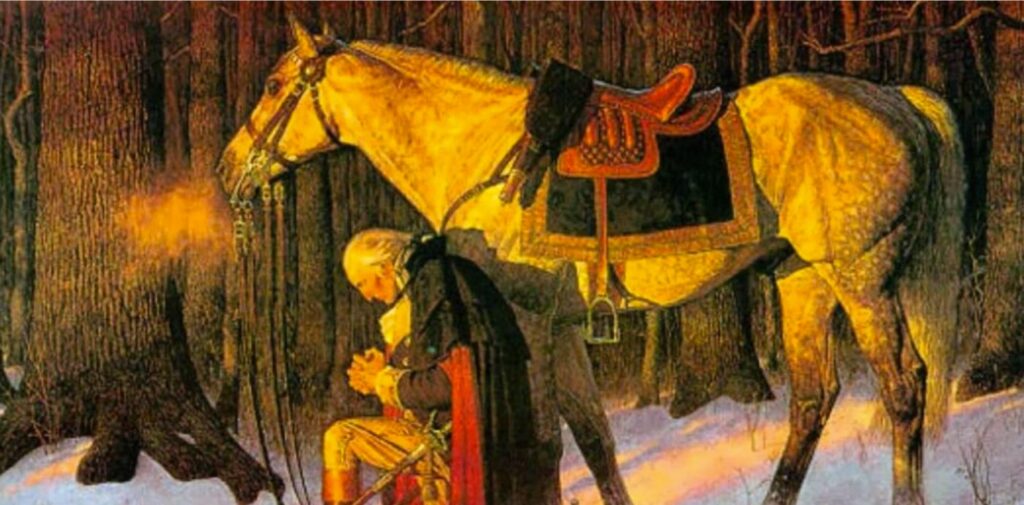

Charlton Heston portrayed a prophet, and also served as one when he encouraged Americans to defy and resist our lawless government-gone-rogue.

King George III called George Washington “the greatest man in the world” because he declined to be king of America, and instead sacrificed himself for the creation of a people-led constitutional republic. Washington prayed hard before leading his surprise attack across the Delaware River. All Americans should aspire to be like Washington, especially in 2024.

talkin turkey

Spring Turkey Season is almost upon us here in Pennsylvania, and around the country. A great deal of the wild turkey breeding season is already behind us, and the significant challenge of calling in a “lovesick tom” at the tail end of the breeding period is now laid before several hundred thousand dedicated and novice turkey hunters alike, here in PA.

Couple of reminders, and one big observation:

- Please do not drive up and down country roads making hen calls out the window of your vehicle, waiting to hear a gobble in response. While it may bring some hunters a premature auditory orgasm to hear the lusty gobbler responses, all this activity really does is educate turkeys about fake calls by fake hen turkeys. And when tom turkeys get unnecessarily educated by guys peeing in their pants with excitement, said toms become a zillion times harder to hunt and bag. It takes the fun out of an already difficult hunt. Don’t do it. Please.

- Clearly identify your male turkey’s red or white head before pulling the trigger on its neck. If all turkey hunters only pulled the trigger when they had absolutely positively identified their target, there would be no heartbreaking hunting accidents during spring turkey season. And when you read the facts surrounding those hunting accidents or negligent shootings, you realize that some people are about to pee in their pants with excitement and so they shoot a human being “in mistake” of a turkey. By only putting our trigger finger on the shotgun trigger when the gobbler’s head is both clearly visible and in range, we bypass a lot of dangerous excitement.

Finally, in a certain nook up north, I have been enjoying the sounds once again of spring gobblers sounding off for probably six weeks now. Few have been the wild turkey gobbles there over the past ten to twelve years, an absence always correlated with the physical evidence of a resident fisher. In other words, fishers have eaten the hell out of our wild turkeys, and only after someone traps the local fisher do the turkey populations begin to rebound. This fact has been driven home for me year after year across southcentral, central, and northcentral PA; fishers have been real hard on our wild turkeys.

Not to say that fishers don’t have a place in Penn’s Woods, they do, of course. But the policy implications of widespread fishers should have been better considered before the giddiness of super-predator 100% ecosystem saturation overtook wildlife managers in the late 1990s and early 2000s. And now Pennsylvania is contemplating releasing pine martens into Penn’s Woods…..knowing already that they eat the hell out of grouse, and that PA’s grouse are in very bad shape.

I don’t mind having a decent population of fishers and pine martens up north in the Big Woods, where they will have the least amount of impact on other wildlife across the entire state. What I do object to is sacrificing the enormous wild turkey conservation success story on the altar of “more predators are better than few” mindset of some wildlife managers. Sometimes, we just have to accept that we can’t wind the clock back to the year 1650, or even 1750, because the few successes we have managed to rack up, like wild turkeys brought back from extinction, is as good as it can get.

Sometimes, good is good enough, and the rest we just need to leave well enough alone.

Central PA candidates on the ballot

Because I am a “politico” actively involved in politics, friends, family, and strangers ask my opinion on candidates running for political office.

Here are the people I am voting for on next week’s Republican primary election ballot:

President: Donald J. Trump, of course. President Trump is all that stands between We, The People and chaos and the forced failure of America as the representative constitutional republic we have enjoyed since 1789.

Attorney General: Dave Sunday. He has a strong 2A background and is endorsed by Gun Owners of America, whereas his opponent has a very poor 2A record.

Congress: Scott Perry. Scott continues to reliably do what an elected official is supposed to do. He has gotten a lot quieter since the lawless Democrat Party thugs known as “FBI agents” stopped his car and stole his cell phone from him at gunpoint last year. Nonetheless, Scott continues to vote for We, The People, like voting against the FISA renewal. FISA has been used by the FBI to conduct lawless, warrantless domestic spying against everyday American citizens.

US Senator: Mickey Mouse. I literally wrote in Mickey Mouse because the GOPe endorsed and orchestrated puppet strings candidate whose name appears on the ballot spent time and money to knock off the ballot several other candidates who would have competed with him in this primary race. What a scumbag.

Auditor General: Tim DeFoor. Tim is a solid citizen and one of the very few now career politicians I can support. I have watched him work his way through the political process, and though he is not ideological, he comes to his traditional views honestly, from the way he grew up, which I can respect.

State Senator: Nick DiFrancesco. This is a newer version of the state senate district seat I ran for in 2012 and 2015, and I have a lot of familiarity with its voters. Nick is an all-around politico who has been a Dauphin County commissioner and has held other publicly visible positions of trust. Nick is presently Dauphin County treasurer, and I believe he represents the only chance normal taxpaying citizens in our region have to stop far-left radical Patty Kim from inheriting this seat in a heavily gerrymandered district made just for her. The other candidate is Ken Stambaugh, who I have had the pleasure of speaking with at length and staying in touch with. Heck of a nice man, good intentions, and not a political animal. My opinion is Ken would stand zero chance against Patty Kim. I yearn for the days when America would naturally and easily elect good people like Ken to office, but unfortunately spring 2024 is as far away from those old days as America can get. We need political warriors.

State Treasurer: Stacy Garrity. Wish we had a primary opponent just for voter choice.

Representative in General Assembly (State House 103rd district): Cindi Ward. Wish we had a primary opponent just for voter choice.

Representative in General Assembly (State House 100th district): Dave Nissley. Failed incumbent and career political hack Bryan Cutler has been a disaster for central Pennsylvania voters who care about good policy and clean politics. Cutler got into elected politics at a very young age, and he just learned bad habit after bad habit along the way. Dave Nissley is by far the better man and the better candidate, and he has been endorsed by Gun Owners of America.

Delegate to the Republican National Convention: Jeff Haste, Sue Helm, George Margetas, and Charlie Gerow. Both Jeff and Sue are well known central PA pro 2A advocates. George Margetas is a local attorney who like so many of us went along with the covid tyranny mask nonsense in 2020, but who then bucked it publicly afterwards when it was clearly evident that covid was about political control and not about public health. I like a strong man who stands up for freedom. Last but not least is well known local politico and lobbyist Charlie Gerow, who I have known for many years and who is one of the few lobbyists I actually like.

The other RNC candidates have either zero about them available online, which tells us they are hiding, fakes, RINOs, or Democrats, or they have something about being “a fiscal conservative,” which is always a red flag for social conservatives looking for strong candidates who will represent traditional values and meritocracy. So-called “fiscal conservatives” rarely are, and they are always social liberals. No thanks.

Guys (men), don’t be an idiot

Emergency Room staff: “Hi there, what can we do for you tonight?”

Me: “I’m an idiot.”

ER Staff: “Yeah, we see a lot of those in here.”

Two hours before, the dry white oak board was very hard, and the cutter blades were very dull, and so that board was giving the cutter fits. Never mind that I had been running the cutter all day to fulfill a large order of oak, and that I had already sharpened the primary blade once, hours before. When the board end bounced off the dull blades, I leaned into it to force the cut. The last thing I remember is a flash of white in the dusk that was enveloping my worksite, and suddenly I knew I was hurt.

Reeling backwards and clutching my face, I first checked my teeth, my eyes, and unhappily noted the gushing blood pouring out of my face. The pain was overwhelming, and the copious blood told me it was serious.

After leaning on the order of banded lumber, hunched over and collecting my wits, I again took stock of my injured face. All my teeth appeared to be in my mouth, and I could see through my heavy wire frame glasses with both eyes. A big pool of blood was congealing on the lumber below me, and blood was liberally dripping and splotching all around me, wherever I went.

“Broken nose, you idiot,” I said out loud, to no one in particular. Time was 7:40 pm and anyone who might have been around to help me during regular working hours would have been long long gone home by then. From March through October I work farmer’s hours, which means work only ends when there is insufficient daylight to work by. When you choose to work until dark and until after dark, which I actually greatly enjoy, you usually work alone. And if you make a stupid, idiot mistake, you will bleed alone. If you are really unlucky or a really big idiot, you will die alone.

So, guys, don’t be an idiot.

Here are the idiot mistakes I made, which you should learn from and not make yourselves:

- Working around machinery and powerful tools while tired is an idiot mistake. All week a cold had dogged me, and even before beginning to work very physically, I was already run down from it. Hinyucking huge gobs of nasty green mucus everywhere every five minutes is a signal that your body is not well, that it is fighting off some infection or cold, and that it needs rest. Take the hint and rest, even a little bit, here and there throughout the day. On top of being sick, I had worked hard all day, lifting and moving logs and lumber, and when the accident happened I was just deeply bone tired from the heavy physical labor work. Mistakes happen much more easily to tired people, because tired people have poor judgment and slow reaction time. I had all of this in spades, and paid for it.

- Don’t work with dull tools. That cutter was battering the last piece of oak, not cutting it, and yet I foolishly leaned in close to physically force the very last piece of wood through. Big mistake. The powerful motor kicked that wood back into my face before I had time to second guess my poor decision. And yes, I had just been telling myself that after this very last piece of wood, I would remove the cutter blades and sharpen them. Too late, idiot.

- Wear correct protective equipment. Gloves are a must around wood and power tools, but the job I was doing also required serious face protection. Because I wear large, rugged eyeglasses everywhere, every iteration of which shows the battle scars of years of hard physical work, I have become a little lazy about better protecting my eyes. That became apparent about ten years ago, when some grinding wheel metal incredibly ricocheted up under my eyeglass lenses at an impossible angle and stuck in my eyeball. Took a while for that junk to work its way out. Just like with the safety event that prompted this particular essay, that day at the grinding wheel I had lazily neglected to simply slop my big clear face shield on my lumpy head and enjoy the benefits of complete protection from flying fragments, impacts, etc. Had I been wearing the face shield, hanging up on the wall just twenty feet away, while running the dull cutter, I probably would have had a good bruise across my face from the kick back, but nothing broken and no lost work time.

Last time I had a broken nose was my senior year in high school. Like the young idiots we were, a bunch of us were playing full tackle pick up football, in the dark. Heavily rushed, the opposite QB had lateraled the football to Rafael Richards, who, being athletic as hell, rocketed straight up the middle. Playing safety position, I put my head down and aimed straight for him. Rafael also put his head down to punch through the defenders, and the two of us woke up a bit later in the Chester County Hospital ER on two gurneys, next to each other. Naturally, we each had a mirror image injury, which included a broken nose and a deep gash in the forehead that required 17 stitches in the meat and another 15 stitches in the skin above.

Rafael went on to get his MD from Harvard Medical School, long before DEI and wokeness there rendered such a degree a question mark, instead of the world class achievement it should be. Somehow I just know that Rafael does not run the risk of getting his nose broken while being a fancy Harvard trained physician in an air conditioned office.

Me? I’m an idiot farting around with penny ante wood orders in the mountains. Because I like it.

But guys, regardless of doing what you like or don’t like, don’t be an idiot.

Cheap but highly effective face shields are sold everywhere for twenty bucks. Buy one and wear it. Don’t be an idiot

How was your eclipse experience?

How was your full solar eclipse experience today? I hope it was fun. A lot of Americans traveled long distances to be within the path of the full eclipse, which stretched across America for a couple hours. Though the actual full eclipse itself was just a couple minutes. My friend Jim drove all the way to Ohio from central PA to see the full eclipse, and yet his attention fell prey to a myriad of beautiful 1960s muscle cars lined up by car-and-eclipse enthusiasts. We men are so weak, so easily distracted. It’s great.

This morning I traveled a couple hours to the Pennsylvania-New York border for a business meeting, after which I drove a few minutes north and crossed into New York State. Right on the edge of the full eclipse. For two hours I did my best to enjoy the event, which was greatly hampered by heavy clouds. Like a tornado hunter there on the PA-NY border, I drove around and took up various positions along paved and dirt roads, a cemetery, a bar parking lot, a cow pasture, trying to beat the clouds or at least find a big wide open space that would give me an idea of when the clouds would open up and give a rewarding, clear view.

Was it seven years ago that we had another solar eclipse? That one we watched with friends at Cherry Springs State Park, and handed around our two welding helmets among our gang and also to other gawkers who asked to borrow them for a moment. That was a memorable day, most especially because it was summertime and the sky was blue. Boy was the eclipse perfectly visible on that day.

Gotta say, the welding helmet, turned up to 13, really saved the day today. The memento “Full Solar Eclipse 4/08/2024” glasses given to me by Chuck (thank you very much) were difficult to see through, and impossible to take photos through. The clouds were often heavy, and blocked the sun completely, forget the eclipse. Welding helmets have a pretty big screen, that is also adjustable, and a camera can be held up to it for a properly filtered picture. So not only was I often able to see the eclipse through the clouds with the helmet, some of my best photos came from light cloud cover.

What a miraculous and fabulous universe we inhabit. And no, we can’t blame this eclipse on “climate change.” Nice try, though.

Jim Eisenhart, Jr. may have been easily distracted by the pretty 1960s muscle cars today, but he did capture the best amateur full eclipse picture I saw

The best part of this photo is the little bit of ominous dark sky at the top. The eclipse turned daytime into a weird glow, a sideways light, not something that normally shines down. These signs lacked shadows, despite the bright sunlight (not sunshine) on them

The “getting old sucks” saga continues

Yesterday, while trying to support local businesses that employee people, I tried out some bricks and mortar stores for size. Looking for a shower brush or large loofa, in several stores I was directed by the nice employees to the shelves containing the toilet bowl brushes. Not one to be easily deterred, I moved on to a store promisingly named “Bath and Body.”

In this store many women happily paused or even languished among pyramids of pretty soap bars, assortments of scented candles in all shapes and sizes, containers of liquid bath soaps and gels, including one in the shape of an elephant. Which I will admit caught my fancy. After I had bulldozed through to the back, without stopping to smell the roses, so to say, I asked a very nice lady employee wearing an apron where I could find such uncommon items as back scratchers, shower brushes, loofas and so on.

Quite seriously, she instructed me to go next door to Marshall’s, and she practically gave me the precise coordinates for what she promised would be the shelves containing exactly what I sought. I thanked her profusely and scurried next door, and followed her step-by-step directions to the correct shelf.

Being presented with the Pet Care products, which in the lady’s defense do contain an assortment of unique brushes and special pet tooth heavy tartar toothpastes for especially bad dog breath, I had to ask myself if, in my dotage, I now really do present a feral image. Or did that nice lady just have a wicked sense of humor. One thing for sure, getting old sucks.

Where men in their late fifties are now supposed to shop for personal care products: Marshall’s pet grooming and care section

My dream clothes washing machine is from 1999

In the past twenty years- plus, an aggressively misleading effort has been shoved down our American freedom-loving throats that the only home appliances we should ever want to own are so energy efficient and water efficient that they don’t actually achieve the results they are made to achieve.

Mostly we are talking about clothes washers (washing machines), although dishwashing machines, ovens, and even microwaves and toaster ovens have been bastardized on the false altar of “efficiency.”

What I miss most about washing machines are two things: A powerful agitator, and a manual override so I can select exactly the combination and level of functions I myself believe best fit the clothes I have placed in the clothes washing machine. I miss these two aspects that were basic to washing machines up until about 1999-2000, because absent them, it is now almost impossible to find a washing machine that actually and fully cleans my clothes.

All electronic/electric clothes washing machines sold today are extremely water efficient, and also extremely energy efficient. For those who struggle with what we are talking about here, neither water efficiency nor electricity efficiency will clean your clothes. You need lots of water and energy to clean clothes in a modern washing machine. Water and electricity efficiency means less of both key ingredients, and energy-efficient machines will not clean your clothes. High efficiency will result in your clothes being far less clean than they could be, were we using a real basic washing machine from 1999.

Today’s washing machines use so little water that the clothes bathing in it are essentially just getting dirty over and over again. Insufficient water is used to actually clean the dirt out of your clothes and hold it in suspension. And the low-electricity thing is just as ridiculous, because the impellers that have replaced agitators do absolutely nothing to actually clean your clothing. What agitators are available on the market are pathetic, limp-wristed little creatures.

Watch an old-fashioned agitator at work. The water is flying everywhere, the clothes are being pushed violently in the water, and your eyes can see that the clothing is being bathed in a lot of water that is also moving very aggressively. That is how clothes get clean.

Now go watch an impeller do its thing. An impeller kind of limp-wrists a pizza throw. It is a half-hearted effort to move whatever is on it. It hardly moves the clothing or the water. I have put folded clothing and sheets and pillow cases in our “deluxe” washer with an impeller, and with the alternative mini agitator, and after the longest possible wash cycle, the objects are removed just as neatly folded as they were when they were placed in the “washer.” Yes, they are wet, but they were not moved around, and the dirt that was lodged in them before they went into the washer is just as lodged as it was in the beginning. In other words, impellers do not work, and claims that they are just a more efficient type of agitator are BS. Your own eyes will tell you this, and probably your nose, too.

And today’s agitators are so small, with such pathetically short turns (guessing about ten degrees of arc) that they, too, do very little to wash the clothes surrounding them.

Why are Americans being fooled into buying electronic appliances that do not work? Because people who think they are smarter and better than us have strong-armed appliance manufacturers to provide “efficient” items that use less water and less electricity than prior models. Yeah, it is true that these dish and clothes washers use less water and less electricity, and it is also true that their amount of clothes and dish cleaning also drops about 90% for the same effort.

The Maytag washer we mistakenly bought takes an hour and a half to do a “Normal” load of wash, and when it is done, we are lucky if the clothes don’t require a second wash. Maytag is not alone; it appears that all of the washing machines made today are just as weak and pathetic.

In other words, “efficient” washing machines are such bad cleaners that they require much more use (= more time, more water and more electricity) to achieve even a modicum of result. The now old fashioned washing machines kicked the crap out of our clothes in a large amount of water, and in about fifteen minutes our entire load of laundry was done. And in fact the formerly dirty clothes emerged very clean.

So my dream washing machine today is one from 1999. It has simple analog turn dials, very few gidgety-gadgety electronics or computer chips, and the entire thing is one big manual override. Every choice I make is because I want that choice and that outcome. The machine makes no choices for me. It is also a top-loading drum that holds enough water to actually wash the clothes that are placed in it, and it has a powerful enough agitator that sweeps far enough (at least a 30 degree arc, and 60 degrees of arc is even better) and aggressively enough to actually knock the dirt off of my clothes and push it into suspension in the abundant water.

That is how we clean clothes with a washer. Anything else is just getting the clothing wet.

When it comes to cleaning my clothes, I really don’t give a cr@p about water efficiency or electrical efficiency. I want performance. The job has to be done right, and whatever it takes to get the job done right is what should be put into the job. Lots of water? OK. Lots of electricity needed to push a powerful motor that churns a strong agitator? OK.

High efficiency? No thanks. I will take the very low efficiency and highly effective washing machine, please.

It is hilarious and also a little spooky that what used to comprise the most basic washing machine that cleaned the most clothing with the least amount of effort is now sold as a machine with “lots of bells and whistles.”

I can’t believe we consumers have to write things like this, because it all seems so self evident. Then again, literally everything surrounding us Americans has been hijacked for some “higher purpose” that ends up leaving us and our needs in the dust. Because the people who push this garbage are “better” than us and “smarter” than us, and they think we are dust, over whom they must exercise heavy manual control.

Funny how symbolically asymmetrical this all is. Like a washing machine that in the 1960s symbolized how advanced America was is now a symbol of how screwed up America has become, and all because of the Left’s extremist politics.

If I could get a “modern” and “high efficiency” washing machine to work half as well as this 1960 model, I would put on a dress and dance around, too

Imagine doing laundry dressed like you were ready to go out for dinner. Oh the painful irony that our grunge-dressing culture embraces crappy washing machines that in fact don’t get the grunge out of our clothing. Some things in Western Civilization were definitely much better in 1961 than now. Probably a lot of things.

DUNE 2 review

Dune captured my young imagination like no other book- not Tolkien’s trilogy, not Starship Troopers, and like Tolkien’s books and Starship Troopers, Dune shaped just about every subsequent sci-fi book, movie, comic book that followed.

Several attempts have been made to capture Dune’s magic in movie form. Prior to the latest two movies, the best known and best produced was the 1984 version with all-star cast Kyle MacLachlan, Sean Young, Sting, Jose Ferrer, Brad Dourif, Richard Jordan, Patrick Stewart, Jurgen Prochnow, Kenneth McMillan, Sian Phillips, Freddie Jones, Linda Hunt, Jack Nance, and other stellar actors. Look up any of these names and you find a talented lifetime actor with lots of real acting gigs to their credit. And as expected, the 1984 Dune movie was very well acted, much better than the latest versions.

Where the 1984 movie was deficient were some of the special effects, and yet some of its special effects were so good that they are repeated in the latest two Dune movies. Fact is, special effects have really improved since 1984, and of course this is where the 2021+2024 Dune movies shine.

If the 1984 Dune movie struggled to get everything just right and onto the screen in a logical flow, which sometimes left it congested, Dune 2 simply ignores certain critical story elements and throws scenes up on the wall, take them or leave them. There is a lot of character and story development in 1984 Dune that is absent in Dune 2.

One scene I was hoping to see is where Fayd Rautha is confronted by the last three Atreides warriors in his gladiator ring, and one of them is not drugged. That fighter just about kills Fayd in the knife fight. In the book that scene takes time to play out, and one gets the impression that Fayd is too used to mock-fighting drugged opponents who cannot possibly bring their full skills or physical power to bear against him. In Dune 2, Fayd just rolls right over his opponents 1-2-3, and there, it’s done. No suspense, no close calls, no embedded darts being painfully but artfully used as improvised armor against Fayd’s quick blade.

The Mentats are pretty much nowhere to be found in Dune 2, which is odd. Dune makes it clear up front that computers and artificial intelligence were banned from human possession, because the computers tried to kill off all the humans and take over their planets. Which gave rise to the Mentats, human computers whose loyalty is first and foremost to fellow humans. Dune 1984 does an outstanding job showing the central role of the Mentats, whereas Dune 2 has none.

One of the biggest deficiencies in Dune 2 is the final battle between Paul and the Fremen, and the Emperor’s forces. Little of the battlefield set-up is explained in Dune 2, and the action just kind of rolls along. The sand worms show up, but not grandly. Maybe the director expects the audience has prior knowledge of the storyline? Plus there are way too many lasers used in Dune 2, because as we do already know, if a laser hits a personal shield, an atomic explosion happens at both ends, killing both parties. Thus, knives and swords were much more handy. I guess lasers look too cool on the big screen to pass up, even if they are not in keeping with the book.

Or Dune 2 could have incorporated the original “weirding” voice module, the Atreides’ secret weapon that is both super high tech and weirdly organic. Dune 1984 did a great job showing how the weirding module greatly enhanced the Fremen fighting ability, thereby enabling them to take on the fully armed Harkonnens. None of this is in Dune 2, strangely.

The 1984 movie ending is far, far superior to the ending of Dune 2: Paul’s raw power is displayed in his fight with Fayd Rautha, whereas in Dune 2 a lot of stuff just doesn’t make sense. Like how does Fayd stab Paul so many times, and why doesn’t the scene follow the book, which is so good, and why doesn’t Paul cut loose after killing Fayd, crushing him and the stone floor with just his voice, thereby demonstrating his overwhelming physical/mystical messianic power…instead of just kind of standing there looking over his defeated enemies….? Curious minds want to know.

Nothing in Dune 2 shows Paul’s slow discovery and then development of his messianic powers, despite that being the entire purpose of the Dune story. Nine hundred generations of careful breeding and genetic modification were supposed to result in the messiah, who could bend space and time on his own, and in Dune and the 1984 Dune, those responsible for creating Paul are amazed that he actually happened. I am amazed that Dune 2 shows its audience almost none of this important part of the overall story. Paul’s emergence and ascent as the universe’s messianic all-powerful super-being leader is the entire point of Dune. How did it evade the producers of Dune 2?

Dune 2 should have just taken the 1984 film and used every scene, every prop, every script and line, and simply updated the actors and the special effects. Oh well. Opportunity missed.

Well, I paid fourteen bucks to go see a Hollywood movie. First one of 2024 and probably going to be the only Hollywood movie I see this year. Regal Cinemas now has assigned seats, which in theory is a nice thing, and which in the theater itself bore no resemblance to the seating map offered on the computer screen when buying my ticket. I did get to sit up front and enjoy the effect of a full size movie screen, which is a lot of fun. It is a shame the movie was not what I expected, or what it could have been, or should have been.

Nice consolation is that I can watch my 1984 Dune DVD at home, as well as watch the excellent cut scenes on YouTube. Hate to say it, Dune 1984 is in many ways much better than today’s Dune 2, but Dune 2 is worth seeing, if you have any affinity for the Dune story. It’s all fun.

Easter & Passover = Time for American Renewal

America as a representative, constitutional republic run by The People is being purposefully killed by the Biden Administration. In case the horrible inflation and scary economy and ATF cold blooded murder-execution of Bryan Malinowski in his bedroom did not grab your attention recently, maybe today’s headlines will: Joe Biden declared today to be a “transgender day of visibility,” despite today actually being Easter.

A more grotesque and purposefully evil statement could not be imagined, but then again, what evil haven’t we seen with Joe Biden. Sorry to the transgender people out there, but today is a major Christian holiday, and to flaunt hypersexual nonsense at the expense of America’s founding belief system is a major slap in the face of all Americans.

If Biden’s bizarre effort to outright ignore Easter and flaunt hyper sexuality seems to you like a big political risk for very little political gain, you are correct. What you are forgetting is that Joe Biden stole the 2020 election and has not felt accountable to voters ever since. This first-ever bizarre day of trans whatever nonsense is what politicians do when they believe they are not going to experience electoral pushback. And if you steal elections, you don’t feel accountable, and you just do whatever crazy crap you want to do. Like tyrants everywhere else.

America is in huge trouble. Enormous trouble. Who the hell ever saw a president so deeply committed to destroying the foundations of America, as well as its national defense, the rights of its citizens, its economy, etc? Joe Biden is not some aberration, he is being inflicted on America in order to destroy us as a people and as a nation. Joe Biden’s constant assault on America is not sustainable, and you should not think that America is too big to fail. You are watching America be failed on purpose right in front of your face.

Easter is based on Passover, which is right around the corner. Easter is more theological and Passover is more about national identity, and I think this year, these two holidays can, and must, together, mark an American spiritual, cultural, and political renewal that is borne out at the ballot box this November. Christians can pray that a free constitutional America rises again, and Jews can pray that a lawlessly brutal and sadistic federal government is defeated by The People, so that The People can go free and live their American lives as was envisioned from the beginning in 1776.

Hopefully enough Christians and Jews recognize that Easter and Passover of 2024 are uniquely placed to prompt them, you, us, to have a spiritual and national renewal, and that such a renewal allows us to throw off Joe Biden’s slave chains, so that we Americans can be a free people once more. This renewal must be implemented at the ballot box this November. The rejection of Joe Biden’s bizarre un-American/ anti-American values must be so overwhelming that there is no hope of his election cheating again this November.

Avoiding payment scams is easy

Last year, some local person took a picture of a check I had written to a local business, and they used that picture to create several fake checks written against my bank account. Because I bank locally with a relatively small bank owned by local people I know and trust, and because I have personal relationships with the bank staff, the forged/fake scam checks were caught right away.

“I looked at that check, and then the next one, and the next one, and just I knew that there was no way that Josh First was writing them. They are ridiculous on their face. I mean…flowers and gourmet cat food? No! No way. I knew that is not Josh. Chainsaws, yes, could be, I could be fooled by that if someone tried it, but gourmet cat food, no, flowers hell no“, said the local bank branch manager with a big smile.

Because the bank manager knows me and my business personally, he was easily able to discern the fake checks from real ones. He saved me a lot of heartache. And so I recommend to you that you use your local banks, that are owned and run by local people. Unlike the big banks like Chase, these local people get to know you, know your face, and are accountable and connected to the community around them.

A month later I got a call from a sweet and very distressed woman in Arizona, who had shipped off five thousand dollars worth of product from her small business based on a check written in my name. No, I assured her, I had nothing to do with it. I had no need for marketing products, and certainly not her particular products. This nice lady and I had a long conversation about how much America has changed in our adulthood, and not for the better. She said the scam had really hurt her financially.

Fast forward almost a year and I recently got a call from a nice young man in Alaska. A check bearing my business name had been used to purchase thirty-five hundred dollars of beauty salon hair and nail products from his friend in Florida, and the proceeds had been sent to Alaska to help him purchase a home there. Only days after he had deposited the check in his account was he informed that the check was bad, and that in fact he did not have the money. His friend in Florida was cheated out of her salon products.

I would say the common thread I have seen across all of these check scams is that the person getting scammed does not really look into the check they have received. For example, why would a buyer of beauty salon products in Florida pay with a check from a business in Pennsylvania that does land and timber work? This obviously makes no sense, and the young man admitted it.

And when I spoke with the nice lady in Arizona last summer, she too admitted that this same issue had given her pause. To which I asked her “Why didn’t you call us with your question before taking the check? We could have easily protected you from committing this mistake.”

Scams are everywhere: Email scams asking for money, phone calls asking for money, malware and phishing scams by email and text (DO NOT CLICK ON THEIR CONTENTS and links), phone calls about getting a low cost mortgage on your penis enlargement, updating your nonexistent home warranty/ extended car warranty/ computer warranty etc etc etc. We are inundated in this garbage.

You have to care about yourself enough to stay on guard and defend your interests. One little mistake can cause you a lot of grief and cost you a lot of money.

The best ways to protect yourself from being victimized are: 1) Ask yourself if this is a service or product I really have? 2) Is this phone call or email a normal way for a real bona fide service provider to communicate? 3) Why is there a company name from far away on this check? And you can always call that company whose name is on the check and ask them if they wrote the check.

Had that happened in the most recent scam, I would have said “I have nothing against dudes who use girl makeup, but I will also say that I am the last man on Planet Earth who would do so, and so there, you have your answer: The check is bad.”

You just gotta ask a question or two if you want to stay out of scam trouble.